2020.11.05 - News

DG Daiwa Ventures Completes Establishment of DG Lab Fund II for Global Startups with Next-generation Technologies with Around 12.5 Billion Yen

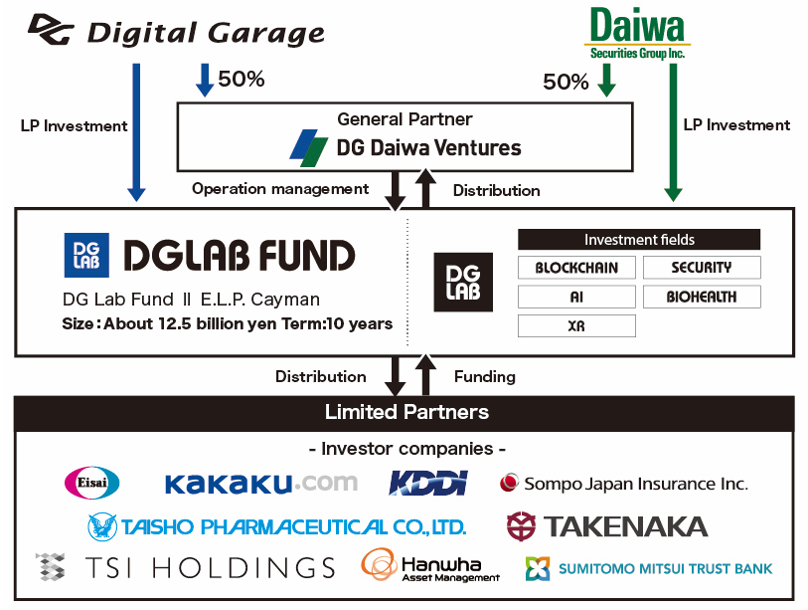

DG Daiwa Ventures Inc. (HQ: Tokyo; Representative Directors: Masahito Okuma and Akihiko Ogino; DG Daiwa Ventures) has completed the establishment of DG Lab Fund II E.L.P. Cayman (in short, DG Lab Fund II), an investment fund for global startups with next-generation technologies, with approximately 12.5 billion yen. Together with DG Lab Fund I, DG Daiwa Ventures will operate funds totaling approximately 20 billion yen.

DG Daiwa Ventures is a venture capital firm jointly established by Digital Garage, Inc. (TSE First Section: 4819; Head office: Shibuya Ward, Tokyo; President and Group CEO : Kaoru Hayashi; hereinafter “DG”) and Daiwa Securities Group, Inc. (TSE First Section: 8601; Head office: Chiyoda Ward, Tokyo; President and CEO Seiji Nakata; hereinafter referred to as “Daiwa Securities Group”). DG Lab Fund II will work with DG Lab—an open innovation R&D organization—and DG Lab Fund LP companies to invest in DG Lab’s five R&D fields: Blockchain, AI, xR, Security, and BioHealth, just like DG Lab Fund I. DG Lab Fund II will precisely understand the diversifying startup circumstances and cutting-edge technological trends to rigorously select and invest in excellent global startups in each field.

■ Capital of around 12.5 billion yen raised from 11 institutional investors and operating companies

Multiple major companies will also take part in DG Lab Fund II as LPs. These include (in Japanese syllabary order): Eisai Co., Ltd.; Kakaku.com, Inc.; KDDI CORPORATION; Sompo Japan Insurance Inc.; Taisho Pharmaceutical Co., Ltd.; TAKENAKA CORPORATION; TSI HOLDINGS CO., LTD.; Hanwha Asset Management Co., Ltd.; and Sumitomo Mitsui Trust Bank, Limited. (as well as other institutional investors.)

■ Partnering DG Lab and its investors to incubate portfolio companies more rapidly

DG Lab Fund II has invested in 13 companies so far and has a track record of over 40 companies combined with DG Lab Fund I. For example, it has provided support for: Goodpatch Inc., which has listed on the Tokyo Stock Exchange’s Mothers section in June 2020 *1; Akili Interactive Labs, Inc., which develops the world’s first game-based digital therapeutic app, and has been cleared by the U.S. Food and Drug Administration (FDA) *2, and Idein, Inc., which is a company globally known for its edge computing technology. In addition, Crypto Garage, Inc. was founded for blockchain financial service development as a joint venture by DG, investee Blockstream—the blockchain infrastructure company—, and DG Lab Fund I investor The Tokyo Tanshi Co., Ltd.. Crypto Garage received the first official authorization in the finance field under the Regulatory Sandbox, managed by the Cabinet Office of Japan, in January 2019, and launched commercial services in June 2020. DG Lab Fund II is currently supporting a number of startups such as Zehitomo, Inc., which operates a customer acquisition platform that enables users to find and hire local service professionals.

To achieve the biggest ROI, choices and investments can be made in excellent startups from a global perspective, as investees are selected from the profusion of international deal sources retained by the DG Group including its Global Incubation Stream connecting North America, Japan, Asia, and Europe. In operating the fund, the Daiwa Securities Group applies its experience and know-how to make the most of these advantages. DG Lab Fund will continue to push forward the development as a venture investment fund with a new structure, utilizing the investment network and incubation competence of the DG Group and the fund management expertise of the Daiwa Securities Group.

◯ Reference links:

*1: https://www.garage.co.jp/en/pr/release/2020/05/20200528/

*2:https://www.akiliinteractive.com/news-collection/akili-announces-endeavortm-attention-treatment-is-now-available-for-children-with-attention-deficit-hyperactivity-disorder-adhd-al3pw

*3: https://www.garage.co.jp/en/pr/release/2020/06/20200609/

【DG Daiwa Ventures】https://dg-daiwa-v.com/en

DG Daiwa Ventures is a venture capital firm jointly founded by DG and the Daiwa Securities Group to invest in startups with next-generation technologies and assist their business development. It has been operating these two funds totaling approximately 20 billion yen and has invested in more than 40 companies to date. DG Daiwa Ventures accelerates investees’ growth by combining the investment network and incubation competence of the DG Group and the fund management expertise of the Daiwa Securities Group, and collaborating with later-stage investors and supporting IPOs and M&A.

【DG Lab】https://www.dglab.com/en

An open innovation R&D organization jointly operated by DG; Kakaku.com, Inc. (TSE first section: 2371; HQ: Tokyo; President and Representative Director: Shonosuke Hata); and KDDI CORPORATION (TSE first section: 9433; HQ: Tokyo; President, Representative Director: Makoto Takahashi). Daiwa Securities Group; TIS Inc.; Resona Bank, Limited.; and Credit Saison Co., Ltd. are sponsoring partners.

【For more information, please contact:】

DG Daiwa Ventures, Inc.

Email: dgdv-info@dg-daiwa-v.com

* This press release is not intended to offer any investment operation services and specific operation products by DG, Daiwa Securities Group, and DG Daiwa Ventures. DG, Daiwa Securities Group, and DG Daiwa Ventures are not calling for any participation of DG Lab Funds I and II through this press release.

Click here for PDF